In an app store with loads of banking apps to choose from, how do you make sure you're picking the right one?

Whether you're looking to switch to a mobile-only bank or are interested in a traditional bank with physical branches, we've rounded up the best mobile banking apps for users in the UK.

What Makes a Good Mobile Banking App?

A good mobile banking app is one that provides a well-rounded experience. In order to do this, the app needs to have a friendly UI, provide useful features, keep your information secure, and function reliably.

Security is a big part of a banking app, for obvious reasons. While there are ways to help keep banking online secure, the app needs to provide its own security. Encrypted data is the best way to do this, and as such is a standard feature.

In this list, we're going to focus on each of the app's standout features—those that are unique to each app and really make it stand out. You know the basics of a mobile banking app: they show your balance, provide access to your accounts, allow you to send money, and the rest. We're only interested in the key features today.

1. Monzo

Monzo is the most popular mobile-only bank in the UK. It launched in 2016 and has grown greatly since then. Monzo provides you with a full overview of your current account. The Monzo app is well-laid out and has an easy and secure login system that sends you an email to log in, rather than using a traditional username and password.

Monzo brings some popular features such as being able to freeze your card, view your card number and PIN, and send easy payments to friends, all using the app.

The most impressive feature in Monzo is Pots. In the app, you can open Pots, which allow you to set aside money within your account. This money can be used as savings, or to pay bills where payments are taken straight from the pot. It's a popular feature with budget-conscious users.

Monzo also provides Savings Pots, where it has partnered with other banks to offer you interest on savings.

Monzo lets you have as many Pots as you want. Another savings feature for Pots is that you can automatically round up your transactions to the nearest pound and put the difference straight into the Pot.

Finally, Monzo offers in-app chat support and has some other great features that make it a worthwhile mobile banking app.

Our Rating: 4.5/5 | Average User Rating: 4.8/5

Download: Monzo for iOS | Android (Free)

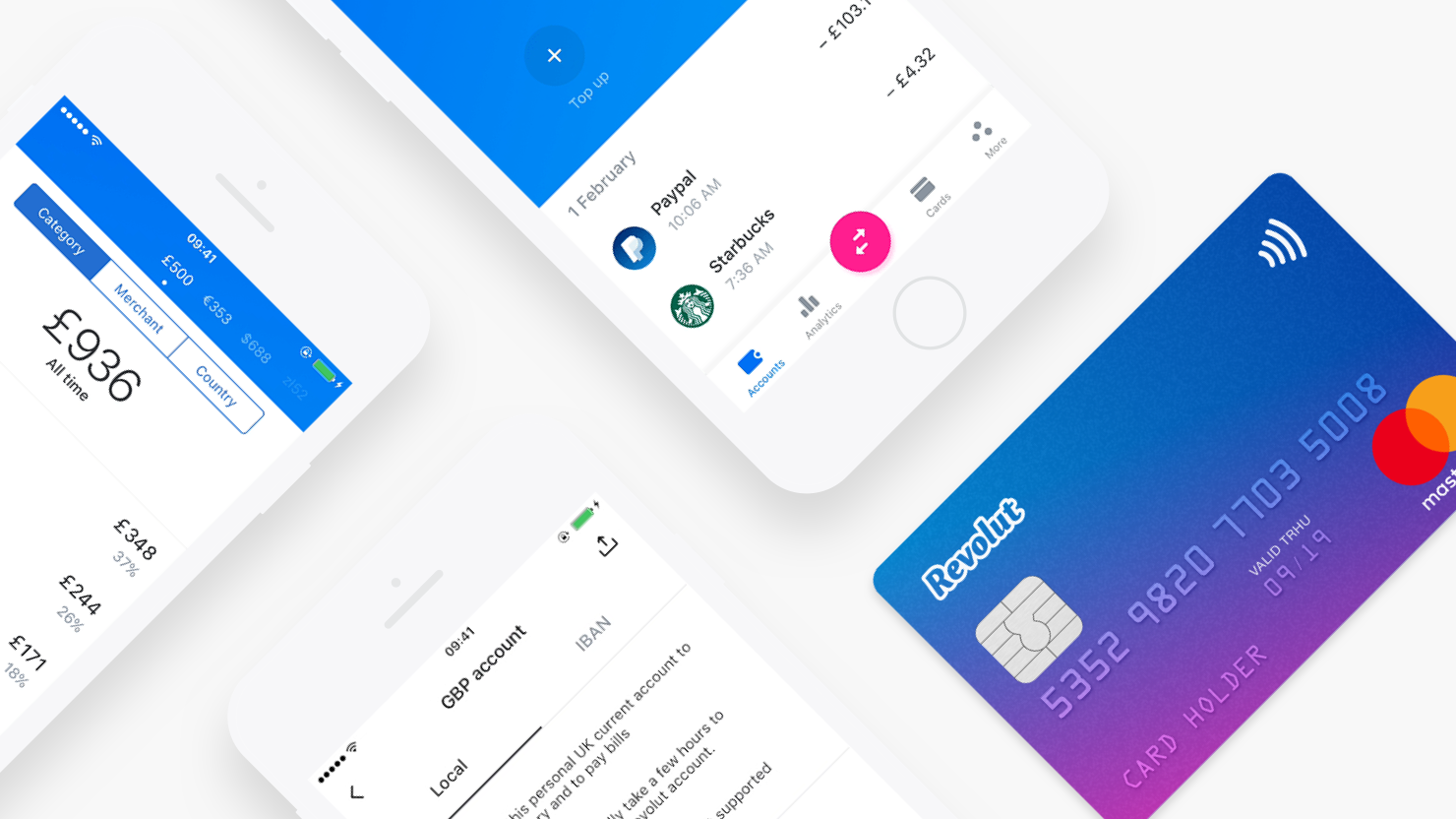

2. Revolut

Revolut doesn't technically operate as a bank in the UK. But when using the app, you'll soon forget that. Once you load your account with money, it acts just like a normal bank account. You can get a virtual card for free to use with Apple Pay or online, and you can pay for a physical bank card too.

The mobile banking app also allows you to pay your friends and other bank accounts from within the app, so you're not missing out on much.

Most notably, Revolut's standout feature is the ability to store and use multiple currencies from within your account. This makes it perfect for getting currencies at a good exchange rate before travel and avoiding credit card fees. Revolut uses up-to-date exchange rates to ensure the exchanges are fair for the customer, so you don't get ripped off when exchanging currencies.

Revolut also offers in-app chat support. Most notably, Revolut also has a cryptocurrency investment section that many other mobile banking apps lack.

Our Rating: 4.5/5 | Average User Rating: 4.6/5

Download: Revolut for iOS | Android (Free)

3. Starling

Starling is another UK mobile-only bank. The Starling app has an intuitive design that's easy to get used to. The homepage shows lots of important information at a glance in an interactive way.

Spending analytics and budgeting are the standout features here. Starling offers a clear and in-depth look at your spending. You can see your spending on retailers and in certain categories for each month. The analytics identify trends in your spending to help with your budgeting.

The app lets you set money aside and set targets for your spending in categories each month.

As with the other apps, Starling offers in-app chat support. Another in-app feature is the ability to create virtual cards for use when spending online. This keeps your real card number a secret for security.

Our Rating: 4/5 | Average User Rating: 4.8/5

Download: Starling for iOS | Android (Free)

4. Barclays

Barclays is a well-known bank across the globe and is popular in the UK. It's a traditional bank, offering a mobile banking app that takes security very seriously.

To create your account and perform certain actions within, you'll need a PINsentry machine. This verifies your card and PIN, along with providing a special access code. YOu can request these machines by phone, online, or in a branch. This focus on security verifies that you're the one performing actions on your account.

The best feature in the app is the ability to add accounts from other banks. Taking advantage of open banking, you can link your accounts to the Barclays app to see your balance and other information at a glance. This is particularly useful for those who have various bank accounts for separate purposes.

Barclays' attempt at a mobile banking app isn't the best. The app has a poor, and sometimes confusing, layout. But it does offer some useful features, such as being able to access different types of support in-app, paying with checks, and seeing all the other Barclays products available.

Our Rating: 3/5 | Average User Rating: 4.7/5

Download: Barclays for iOS | Android (Free)

5. HSBC

HSBC is another traditional bank, well-known around the world, that provides a mobile banking app.

The HSBC app is perfect for managing your international HSBC accounts, as well as your UK one. For the accounts, you can transfer money between them, as well as to other bank accounts. HSBC provides quick access to its in-app support as well, which is easy to find.

The Balance After Bills section of the app is HSBC's standout feature. In this section, the HSBC app allows you to see your upcoming bills, along with what your account balance will be after those bills are taken.

HSBC adds bills automatically from your regular transactions. This feature is particularly useful to help budget your finances on a monthly basis.

Despite this, HSBC's app is also quite lacking. The design is simple, and aside from the After Bills feature, there are no other notable inclusions.

Our Rating: 2/5 | Average User Rating: 4.2/5

Download: HSBC for iOS | Android (Free)

6. Lloyds

Lloyds is another traditional bank in the UK providing a mobile banking app to access and manage your accounts. The Lloyds app lets you pay in checks, which is a feature only some of the traditional banks' apps offer.

Lloyds' app provides you with a transaction map to visualize all the purchases you've made. This is particularly useful if you have a visual memory or often forget where you made purchases. It's also important from a security aspect, as it helps make sure there are no obvious unfamiliar transactions on your account.

The Lloyds app has a few features, but nothing groundbreaking. There is a whole tab dedicated to applying for credit cards, which seems a bit heavy on advertisements. The app works well and has a simple UI, but there's not much more to it.

Our Rating: 3/5 | Average User Rating: 4.7/5

Download: Lloyds for iOS | Android (Free)

Which UK Banking App Should You Use?

We've examined the best features for these highly reviewed mobile banking apps. Each of them has at least one standout feature that makes it a good choice for certain types of users. We recommend taking a look at the features and working out which app seems most appropriate for your needs.

However, it does seem pretty clear that the mobile-only banks provide much better apps than the traditional banks. It's also worth noting that none of the mobile banking apps provided by standard banks allow you to open an account from within the app.