At the height of the first NFT wave in 2021, Ethereum’s gas fees became exorbitantly high. As more people entered the world of DeFi, Ethereum’s network became saturated (again). In turn, for every transaction, traders had to dish out more money.

Thankfully, a Binance Smart Chain (BSC) alternative was ready to welcome Ethereum’s traffic overflow. One of the biggest beneficiaries was PancakeSwap, BSC’s most popular decentralized exchange (DEX), equivalent to Ethereum’s Uniswap.

So, what is PancakeSwap, and can you use it as a form of passive income?

What Makes a DEX Different From a CEX?

Just until a few years ago, there was no such thing as a decentralized exchange or DEX. Whether one wanted to exchange stocks, commodities, or cryptocurrencies, one had to seek the services of a centralized exchange or CEX. Run by regulated companies with deep pockets, CEXes provide the market with the necessary liquidity for it to function.

For instance, if you wanted to buy a Tesla (TSLA) stock share, the market would have to have a seller. However, what happens if, at that particular moment, there is no seller? This is where market makers—NYSE or Nasdaq or Citadel Securities—come in. These exchanges provide market liquidity by acting as a buyer/seller whenever a trade is initiated.

By covering asks (sell orders) and bids (buy orders), CEXes ensure optimal market flow. In turn, one of the ways they make money is by charging a tiny fee for the asset that is being exchanged—either sold or bought. The question then is, how can DEXes provide the same function—market liquidity—without having a centralized operation with deep pockets to cover all the ask/bid spreads?

Revolutionary Blockchain Invention—AMMs

As you may have noticed, not all blockchains are created equal. Cryptocurrencies like Dogecoin (DOGE) run on a blockchain that has no other purpose but to provide transactions. However, both Ethereum and Binance Smart Chain are generalist blockchains.

Thanks to smart contracts embedded into each data block, these blockchains can digitize and auto-execute any activity that can be legally constructed. One such activity is trading, covered by smart contracts called Automated Market Makers or AMMs.

AMMs ensure that DEXes function as well as CEXes by providing market liquidity. The two key components to make that happen are liquidity pools and liquidity providers. Let’s take a look at PancakeSwap to see how that would unfold in action. More importantly, how you could make money from this mechanism.

AMMs and Slippage

Before we delve into the workings of PancakeSwap, there is another important matter to understand. On a regular centralized exchange like Binance, traders rely on the firm to cover the ask/bids for tokens. As with stocks and commodities, it is very important that an initiated trade executes quickly.

Otherwise, you get slippage—the change of the sell/buy price between the market order and its execution time. This price differential is called Slippage Tolerance, with the norm being around 0.5% on DEXes. The more there are liquidity providers on a DEX, the Slippage Tolerance will be less.

The most common way to avoid slippage is to use limit orders. A limit order allows traders to either a maximum buy limit or a maximum sell limit. In other words, the market order won’t execute until those conditions are met. This brings us to how PancakeSwap and other DEXes work.

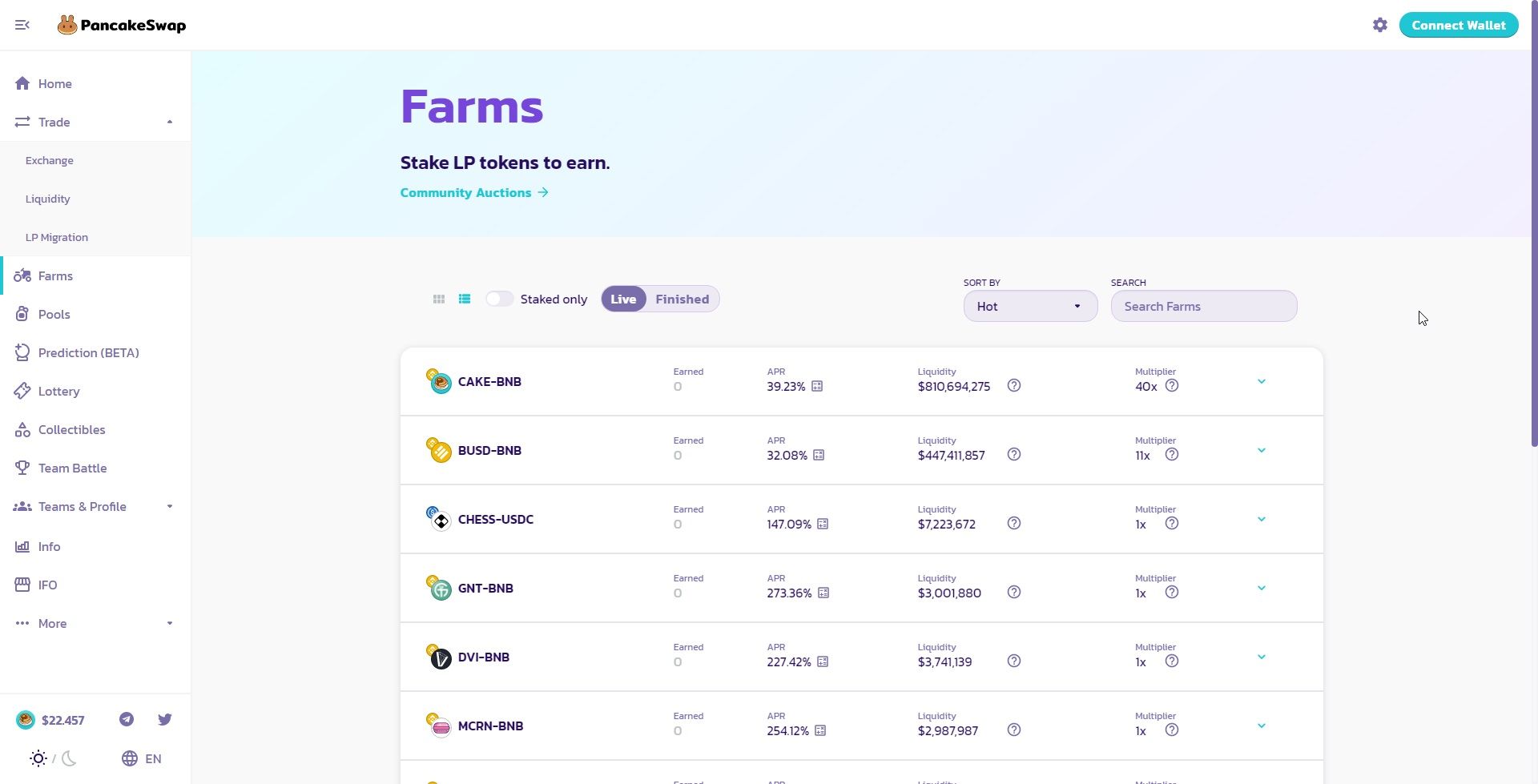

PancakeSwap’s Yield Farming

As mentioned previously, AMMs consist of liquidity pools and liquidity providers. Liquidity pools are smart contracts that contain a certain number of tokens as pairs. Therefore, whenever a trader wants to exchange tokens, they must tap into a liquidity pool.

For example, the BUSD/WBNB token pair in a liquidity pool is for exchanging stablecoin BUSD for wrapped BNB token and vice-versa. WBNB is used for trading with altcoins, while BNB is the equivalent to ETH on Ethereum. In other words, a dApp built on Binance Smart Chain would be able to use WBNB—a BEP-20 token—while BNB token itself is BSC’s native cryptocurrency.

To make these decentralized token exchanges work, there has to be an incentive for liquidity providers. After all, they are the ones who stake their crypto assets into liquidity pools. With PancakeSwap, the liquidity pools are called Syrup Pools, and the reward comes in the form of CAKE tokens.

Any time other traders dip into your Syrup Pool, you earn CAKE, depending on the amount of crypto you have locked in. Presently, one CAKE is worth ~$24.6, as expressed in BSC’s stablecoin, BUSD.

You can create a Syrup Pool with CAKE/BUSD or CAKE/BNB as token pairs. As you can see, this is what is meant by yield farming—you become a yield farmer when you provide liquidity to the crypto market.

Is PancakeSwap Worth It?

Since the Federal Reserve (and other central banks worldwide) engage in unprecedented money printing, commercial banks offer nearly zero APY (annual percentage yield). For example, Chase Savings bank accounts offer an interest rate of 0.01% APY.

In contrast, providing liquidity via PancakeSwap is light years ahead.

The APY for staking in the CAKE Syrup Pool is around 175% on your locked-in cryptos. This is why PancakeSwap exploded in popularity, only behind Ethereum’s Uniswap in terms of the trading volume.

As such, PancakeSwap is obviously an enticing investment opportunity compared to the traditional banking sector, except for one catch—impermanent loss. If the price of your staked tokens changes from the time you lock them into a Syrup Pool, you stand to lose. However, trading fees can still compensate for this if the price change is not too severe.

Lastly, PancakeSwap has an additional offering in the form of a lottery. In exchange for a lottery ticket as a CAKE token, users stand to win a hefty sum of CAKE. The winner’s ticket would have to match six numbers to win 40% of the prize pool, with each ticket having a 1 in 10 chance to match the first number.

Predictably, only the most disciplined users with a compounding ticket technique would stand apart from the losers. It goes without saying that becoming a regular yield farmer brings much less risk.

![How to Find IMSI Number on iPhone [Helps with iOS Unlock][Updated] data:post.title](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjLjHwhnfUXNJTuiylqmlurhLRVAEVi803j6xcnvN8EZwF5_XUynz1y0Ko-vwpx6O3nT5hogTELahedGzgQpXM5Y99fcBliinyBu8ACw8_DVV3FpPLkIqR0u7v_HM39rAkpV5MyJiG1h5s/s72-c/find+imsi+iphone.jpg)